***Sponsored by LFG Equities Corp and Disseminated on Behalf of STREAMEX Corp

Streamex Exchange Corp NASDAQ-STEX Creates a Tokenized Yield-Bearing Gold Product Generating up-to 4% through Exclusive Partnership with Monetary Metals

STEX & Simplify Asset Management $10 billion USD AUM ETF Manager Announces Letter of Intent Pursuing a Strategic Partnership to Drive ETF Innovation through Integration of Tokenized Gold Yield Assets and Tokenization of Existing ETFs

Tokenization goes Mainstream as the Nasdaq is working with U.S. regulators to introduce trading of tokenized securities!

__________________________________

Hello Everyone,

We have something New for you to take a look at for Thursday’s session.

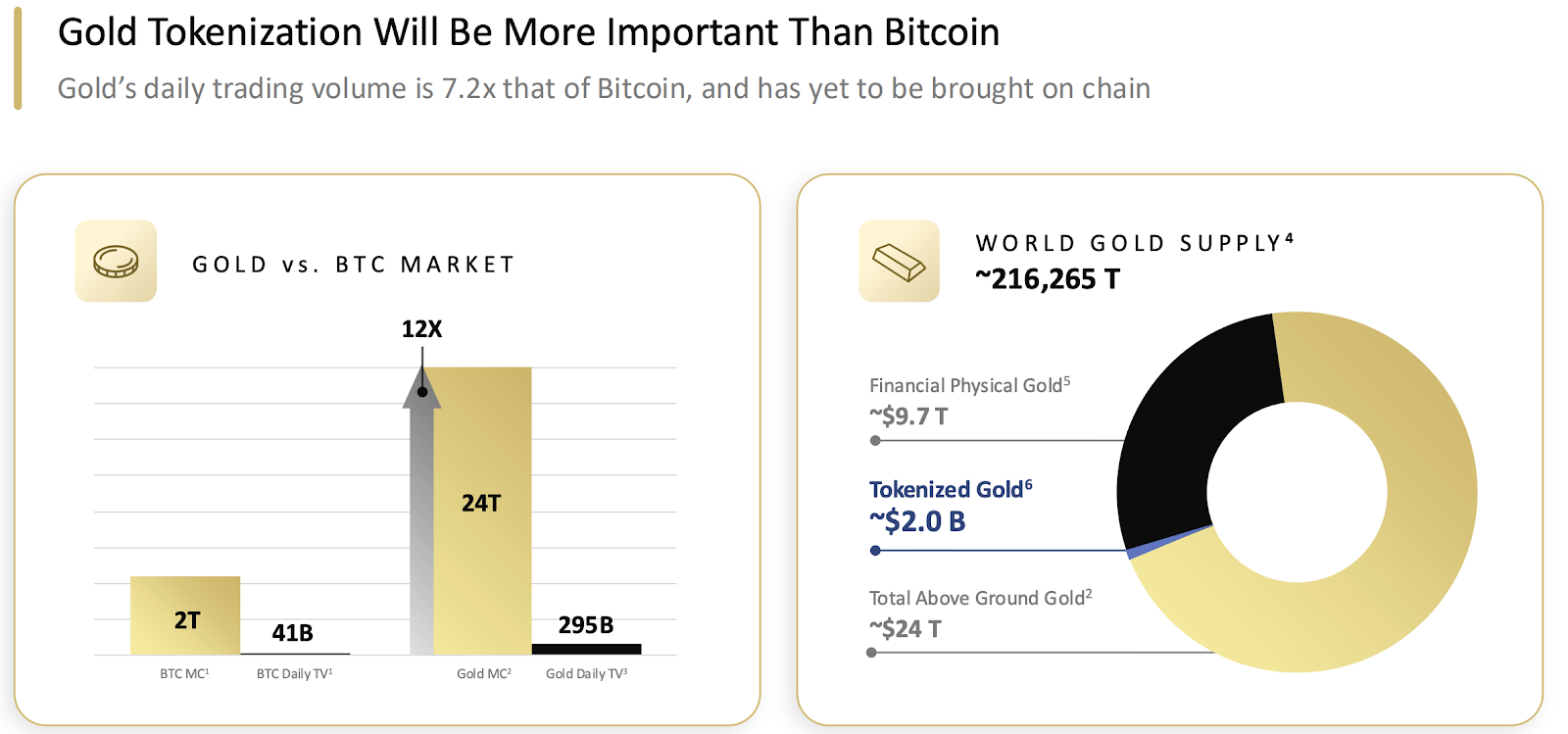

Pull up STEX right away. STEX has an institutional grade infrastructure to bring the gold and commodities market on chain. Enabled by a gold denominated treasury and tokenization technology powering the modern commodities market.

Real World Asset (RWA) tokenization is the process of taking a tangible or traditional financial asset—like real estate, commodities, bonds, art, or private equity—and representing ownership of it on a blockchain as digital tokens. Instead of owning the physical asset directly, investors hold tokens that represent fractional ownership, rights, or claims to the asset.Then the tokens are recorded on a blockchain, making them easier to transfer, trade, and verify.

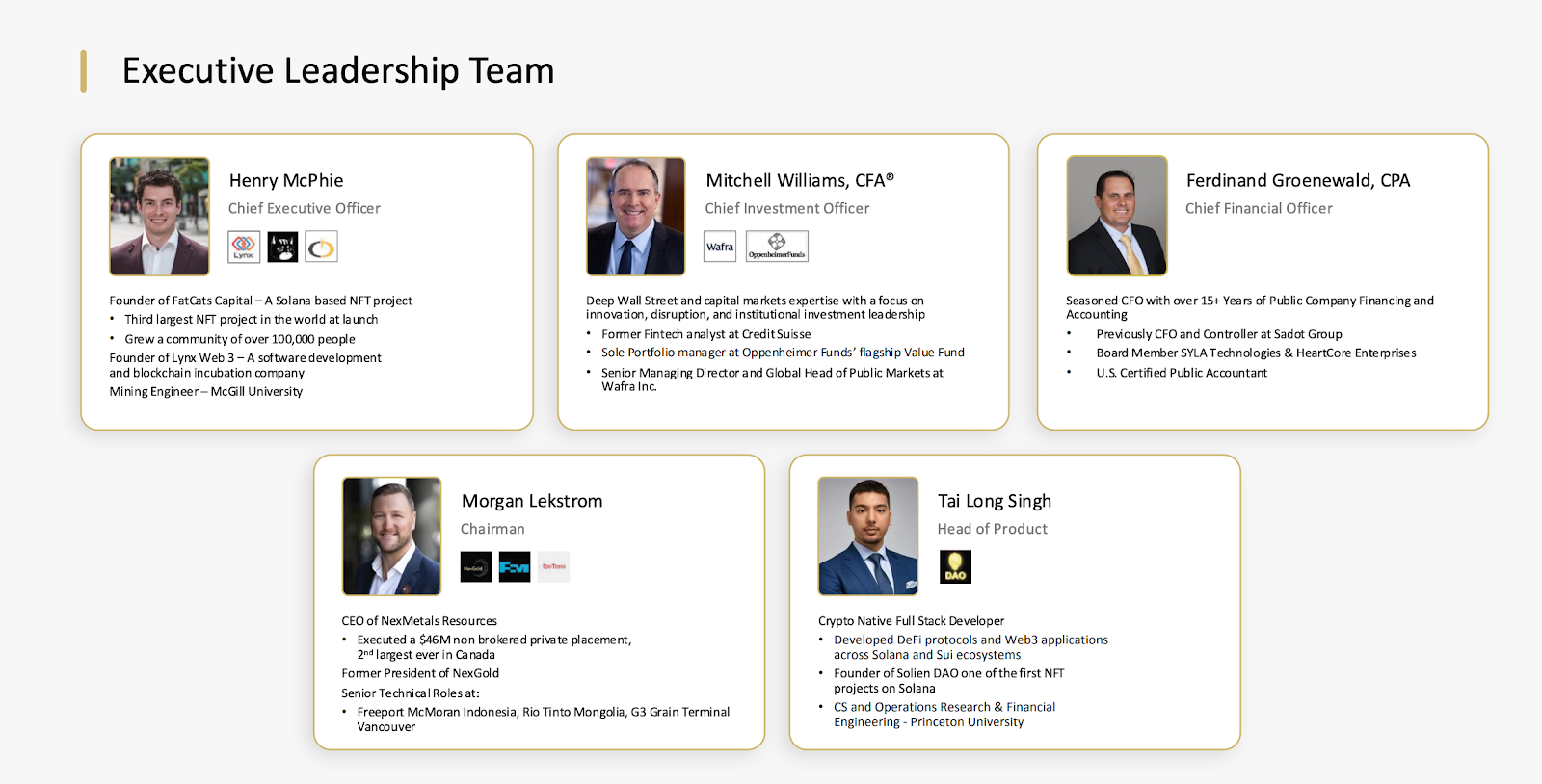

Streamex is led by a group of highly successful and seasoned executives from financial, commodities and blockchain industries.

STEX believes the future of finance lies in tokenization, innovative investment strategies, and decentralized markets. By merging advanced financial technologies with blockchain transparency, STEX has created infrastructure and solutions that enhance liquidity, accessibility, and efficiency. Streamex’s goal is to bridge the gap between traditional finance and the digital economy, unlocking new opportunities for investors and institutions worldwide.

There is no doubt that we are seeing Tokenization go mainstream!! The Nasdaq is currently working with U.S. regulators to introduce trading of tokenized securities, becoming the latest major financial player on Wall Street to double down on a boom in tokenization amid an easing of crypto regulations under the Trump administration.The same rails used for crypto and stablecoins are now powering real-world assets with full regulatory visibility. Liquidity is about to be redefined. When assets like gold, equity, or real estate become programmable and tradable 24/7, the financial system itself changes. Trust is being rebuilt digitally. On-chain assets offer provenance, transparency, and real-time auditability, the opposite of opacity and settlement delays in legacy systems.

Nasdaq isn’t the only company hopping on the trend. LSEG – The London Stock Exchange Group unveiled a Digital Markets Infrastructure (DMI) platform for private funds, supporting issuance, tokenization, and settlement in more digital form. WisdomTree launched a tokenized alternative income / private credit digital fund. These are just a few small examples.

If you are not familiar with the technology then I suggest you acquaint yourself quickly. Some of biggest news announcements of 2025 have involved either tokenezations of assets or building crypto treasuries. Wall Street is falling in love with digital assets.

STEX has dropped some BIG news announcements recently:

Streamex Exchange Corp NASDAQ-STEX Creates a Tokenized Yield-Bearing Gold Product Generating up-to 4% through Exclusive Partnership with Monetary Metals

Partnership unlocks exclusive tokenization rights, a four percent (4%) annual yield target on physical bullion, revenue share tied to leasing volumes and the creation of a groundbreaking institutionalized asset providing yield on physical gold holdings

Key Partnership Highlights

- Streamex secures exclusive tokenization rights for yield-bearing gold products through Monetary Metals

- Investors gain access to an estimated four percent (4%) annual yield through tokenized bullion assets and gold treasury

- Strategic structure includes revenue share tied to gold leasing volumes on Monetary Metals’ platform

LOS ANGELES and SCOTTSDALE, Ariz., Sept. 08, 2025 (GLOBE NEWSWIRE) — BioSig Technologies, Inc., which recently merged with Streamex Exchange Corporation (“Streamex”) (Nasdaq: STEX), together with Monetary Metals, a pioneer in gold and silver denominated financial products and strategies, today announced an exclusive long-term strategic partnership to launch a groundbreaking up to 4% yield generating gold product supported by Streamex’s tokenization and treasury platforms.

Through this collaboration, Streamex will gain exclusive rights to tokenize yield-bearing gold products while Monetary Metals provides access to its precious metals leasing and bond programs. Through the partnership, Streamex expects to offer investors an opportunity to earn an estimated four percent (4%) return on the tokenized gold bullion products that the Company will offer, as well as earning a return on the Company’s own gold treasury holdings.

“This collaboration represents a breakthrough in bridging the traditional gold market with digital assets,” said Henry McPhie, CEO of BioSig and Co-Founder of Streamex. “By earning yield on our gold holdings and creating tokenized yield products, we are building the foundation for scalable, institutional-grade instruments that can support billions of dollars in investment and unlock entirely new opportunities for investors.”

Under the agreement, Streamex will act as the exclusive tokenization partner of Monetary Metals for a minimum of three years, creating and distributing yield-bearing digital assets that combine the strength of physical bullion with the innovation of blockchain-based markets. Streamex will fund at least ten percent of the book of eligible Monetary Metals’ gold leases.

The agreement also provides Streamex with a revenue share tied to leasing volumes on Monetary Metals’ platform. This structure creates a mutually aligned model designed to scale significantly, institutionalizing yield-bearing bullion products backed by a comprehensive treasury strategy.

“Gold is a global, financial asset with deep liquidity. Paying fees to let it sit idle in a vault should not be the only option. Our vision has been to unlock gold’s natural utility by using it to finance real-world businesses and generate a yield,” said Keith Weiner, Founder and CEO of Monetary Metals. “We are excited to work with Streamex to create new ways to deliver gold yield to global markets, including tokenized solutions that combine the trust of gold with the accessibility of blockchain. This partnership is a major step on the road to gold reclaiming its place in global finance.”

About Streamex

Streamex is an RWA tokenization company building Institutional grade infrastructure to bring the gold and commodities market on chain, enabled by a gold denominated treasury and tokenization technology powering the modern commodities market. Streamex is a wholly owned subsidiary of BioSig Technologies, Inc.

About Monetary Metals

Monetary Metals® is Unlocking the Productivity of Gold™ by offering a Yield on Gold, Paid in Gold® to investors, and Gold Financing, Simplified™ to gold-using businesses (mints, miners, refiners, jewelers, etc.). Since 2016, individuals and institutions around the world have been earning interest in gold and silver every month through its Gold Yield Marketplace®.

ADD

Streamex Corp., NASDAQ: STEX & Simplify Asset Management $10 billion USD AUM ETF Manager Announces Letter of Intent Pursuing a Strategic Partnership to Drive ETF Innovation through Integration of Tokenized Gold Yield Assets and Tokenization of Existing ETFs

Partnership with Simplify Asset Management Unlocks Significant Opportunity for Demand of Streamex’s Yield-Bearing Gold Token and additional tokenization opportunities with Simplify, AUM of $10,017,260,875 as of 09/15/2025

September 17, 2025 19:01 ET | Source: Streamex Corp.

Key Partnership Highlights:

- Streamex & Simplify have entered into a letter of intent outlining a framework for pursuing a strategic partnership to leverage each other’s platforms for next-generation financial products.

- Focus on the integration of Streamex’s tokenized yield-bearing gold into ETF structures, bridging blockchain innovation with institutional-grade financial products.

- Distribution expansion across both partners’ platforms, subject to definitive agreements and regulatory approval.

- Jointly intending to collaborate, subject to definitive agreements, on developing ETP/ETF offerings designed to expand investor access to regulated, liquid, and yield-generating gold and commodity-backed products.

NEW YORK and LOS ANGELES, Sept. 17, 2025 (GLOBE NEWSWIRE) — Streamex Corp. (“Streamex”) (NASDAQ: STEX), a leader in institutional-grade tokenization of real-world assets, today announced the signing of a letter of intent with Simplify Asset Management (“Simplify”), an exchange-traded fund (“ETF”) manager with more than $10 billion USD in assets under management. The potential partnership intends to explore the integration of Streamex’s tokenized gold yield product within Simplify’s ETF structures and establish a framework to co-develop tokenized exchange-traded product (“ETP”)/ETF solutions, subject to definitive agreements and regulatory approval.

Under the terms of the letter of intent, Streamex and Simplify intend to collaborate to design, launch, and distribute products that integrate tokenized commodities, beginning with gold, into ETF and ETP vehicles. This effort aims to expand ETF innovation beyond traditional equities and fixed income, while providing scalable, blockchain-enabled access to yield-bearing precious metal strategies.

Through this potential partnership, Streamex’s yield-bearing gold token may be embedded directly into Simplify’s ETFs, effectively bridging blockchain-based tokenization with the regulated ETF market. This integration is expected to create significant institutional demand for Streamex’s Gold Yield Token by providing ETF investors with direct exposure to yield-generating, tokenized gold assets within trusted, liquid, and regulated products.

“This is a transformative step in uniting the $10 trillion USD ETF industry with the innovation of real-world asset tokenization,” said Henry McPhie, CEO of Streamex Corp. “Simplify’s reputation for product innovation and deep ETF distribution, combined with Streamex’s tokenized gold infrastructure, will unlock new pathways for institutional and retail investors to access yield on gold inside regulated ETF wrappers.”

“Gold is a cornerstone of global portfolios, but until now, investors have been limited to non-yielding exposures,” said Paul Kim, CEO & Co-Founder of Simplify Asset Management. “By incorporating Streamex’s tokenized gold yield products into our ETFs, we are unlocking an entirely new investment category: regulated, yield-bearing gold accessible through the familiar ETF structure.”

STEX Engages CXG to Acquire FINRA/SEC-Registered Broker-Dealer to Expand Publicly Traded RWA Tokenization Operations

Will Position Streamex as one of the first NASDAQ Listed SEC and FINRA Compliant Issuers of RWA Tokens in the U.S.

LOS ANGELES & VANCOUVER, British Columbia–(BUSINESS WIRE)– BioSig Technologies, Inc. (NASDAQ: STEX) (“BioSig”), which recently merged with Streamex Exchange Corporation (“Streamex”) (together, “STEX” or the “Company”), is excited to announce a critical step toward becoming one of the first fully regulated Real-World Asset (“RWA”) tokenization companies trading on a major United States exchange: Streamex has engaged Compliance Exchange Group (CXG) to lead and manage the acquisition of a specific FINRA and SEC registered broker-dealer with licensed operations.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250714401245/en/

- Acquisition of the broker dealer, once complete, will create an entity with a significant first-mover advantage in U.S.-major-exchange-traded RWA-backed tokenized investment opportunities for both major institutional and retail investors in the U.S.

- This capability is expected to significantly accelerate adoption and network effect growth of Streamex’s proprietary on-chain RWA commodity market platform.

- The Company will also continue to seek out other broker-dealer opportunities in other strategically advantageous countries.

Management notes the near-term vision is to provide access to fully compliant, gold-backed tokenized assets for U.S. institutional and retail investors targeting the $22 trillion global gold market within the $142 trillion commodities sector, while engaging network-effect-based accelerating growth for the Streamex proprietary on-chain RWA-backed commodity exchange and financing ecosystem.

Strategic Benefits After Acquisition

- First-Mover Advantage: Streamex will be among the first Nasdaq-listed companies to issue regulated, gold-backed RWA tokens.

- Regulatory Compliance: Full compliance with both FINRA and SEC regulations, aligning with emerging U.S. digital asset frameworks.

- Scalable Platform: Streamex’s Solana-based blockchain enables fast, low-cost issuance and trading of gold-backed tokens, making gold investment accessible to all, with additional commodities markets to come.

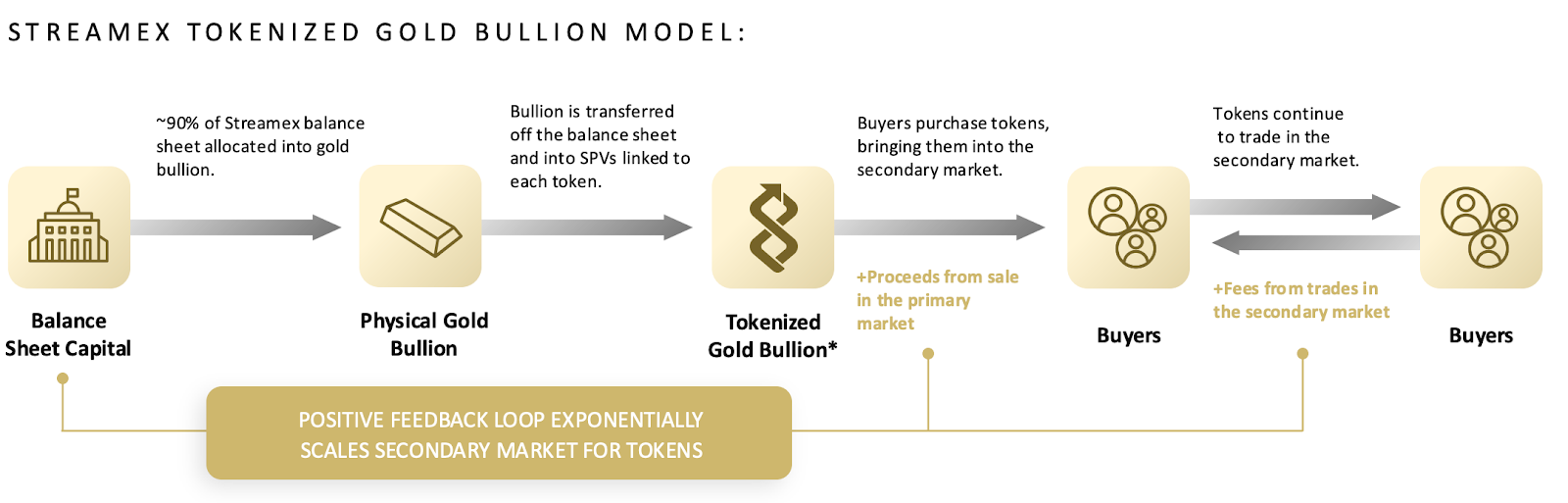

- Gold-Backed Growth: Streamex aims to hold significant quantities in vaulted gold by 2026, denominating its balance sheet in physical gold to support a recurring revenue model.

Why It Matters

Near term, the acquisition positions Streamex to bridge traditional finance and blockchain, offering a seamless way to invest in physical gold through digital tokens. Investors can buy fractional shares of gold with the ease of cryptocurrency, while businesses gain new ways to raise capital. This move aligns with global trends, as institutions like BlackRock and Goldman Sachs tokenize billions in assets, and U.S. regulators begin to clarify digital asset rules.

“The acquisition will be a defining moment for Streamex and BioSig,” said Henry McPhie, CEO of BioSig and Co-Founder of Streamex. “Acquiring a regulated broker-dealer will help us build the infrastructure to lead the gold tokenization market in the U.S. Our Nasdaq listing and gold-backed platform will unlock unprecedented opportunities for investors and reshape the $22trillion gold market.”

Morgan Lekstrom, Executive Chairman of the Company, added: “Tokenizing gold is the future of commodity finance. Streamex’s regulated approach and public market presence make it a pioneer in this transformative space, with the potential to redefine how investors access real assets.”

About the Acquisition

The FINRA and SEC-registered broker-dealer, with a presence the U.S., will provide Streamex with the regulatory framework to issue and trade tokenized assets under federal securities laws. Compliance Exchange Group (CXG), a leader in broker-dealer compliance, will oversee the acquisition to ensure seamless integration and adherence to regulations. This acquisition is a critical step toward scaling Streamex’s RWA tokenization platform nationwide.

About Streamex Exchange Corporation

Streamex is a gold treasury and infrastructure company building the foundation for on-chain commodity markets. With a focus on real-world asset (RWA) tokenization, Streamex is developing a vertically integrated platform that combines token issuance, trading infrastructure, and physical gold holdings positioning the Company to become one of Nasdaq’s largest public holders of gold bullion.

This strategic approach aligns with Streamex’s mission to reshape global finance by bringing the approximately $142 trillion global commodities market on chain. By merging the security and trust of physical gold with the efficiency and transparency of blockchain, Streamex is creating scalable financial infrastructure for a new era of digital commodities.

The Company plans to hold significant quantities of physical gold, securely vaulted through a top-tier bullion bank. Streamex will denominate the majority of its balance sheet in vaulted gold rather than fiat currency, supporting a long-term, value-based financial model. Combined with Streamex’s Solana-based blockchain infrastructure, this strategy enables a recurring revenue model that supports the issuance of gold-backed digital assets.

Streamex is a wholly owned subsidiary of BioSig Technologies, Inc.

About Compliance Exchange Group (CXG)

CXG specializes in building, managing and supporting Broker-Dealer infrastructure, offering full-service compliance, registration, principal outsourcing, and advisory services.

NEWS

7 days ago

Sep 17, 2025

BioSig Technologies, Inc. Announces Corporate Rebrand to Streamex Corp.

Sep 10, 2025

Sep 9, 2025

Sep 8, 2025

Sep 2, 2025

Aug 28, 2025

BioSig Technologies, Inc. & Streamex Announce Closing of $15 Million Public Offering

Aug 15, 2025

BioSig Technologies Inc. Announces Pricing of $15 Million Public Offering

Aug 13, 2025

MANAGEMENT

SINCERELY,

DISCLAIMER

THIS WEBSITE/NEWSLETTER IS OWNED SUBSIDIARY BY DEDICATED INVESTORS, LLC.

OUR REPORTS/RELEASES ARE A COMMERCIAL ADVERTISEMENT AND ARE FOR GENERAL INFORMATION PURPOSES ONLY. WE ARE ENGAGED IN THE BUSINESS OF MARKETING AND ADVERTISING COMPANIES FOR MONETARY COMPENSATION. WE HAVE BEEN COMPENSATED A FEE OF TWENTY THOUSAND USD BY LFG EQUITIES CORP FOR A ONE DAY STEX AWARENESS CAMPAIGN. NEVER INVEST IN ANY STOCK FEATURED ON OUR SITE OR EMAILS UNLESS YOU CAN AFFORD TO LOSE YOUR ENTIRE INVESTMENT. THE DISCLAIMER IS TO BE READ AND FULLY UNDERSTOOD BEFORE USING OUR SERVICES, JOINING OUR SITE OR OUR EMAIL/BLOG LIST AS WELL AS ANY SOCIAL NETWORKING PLATFORMS WE MAY USE.PLEASE NOTE WELL: DEDICATED INVESTORS LLC AND ITS EMPLOYEES ARE NOT A REGISTERED INVESTMENT ADVISOR, BROKER DEALER OR A MEMBER OF ANY ASSOCIATION FOR OTHER RESEARCH PROVIDERS IN ANY JURISDICTION WHATSOEVER.RELEASE OF LIABILITY: THROUGH USE OF THIS WEBSITE VIEWING OR USING YOU AGREE TO HOLD DEDICATED INVESTORS LLC, ITS OPERATORS OWNERS AND EMPLOYEES HARMLESS AND TO COMPLETELY RELEASE THEM FROM ANY AND ALL LIABILITY DUE TO ANY AND ALL LOSS (MONETARY OR OTHERWISE), DAMAGE (MONETARY OR OTHERWISE), OR INJURY (MONETARY OR OTHERWISE) THAT YOU MAY INCUR. THE INFORMATION CONTAINED HEREIN IS BASED ON SOURCES WHICH WE BELIEVE TO BE RELIABLE BUT IS NOT GUARANTEED BY US AS BEING ACCURATE AND DOES NOT PURPORT TO BE A COMPLETE STATEMENT OR SUMMARY OF THE AVAILABLE DATA. DEDICATED INVESTORS LLC ENCOURAGES READERS AND INVESTORS TO SUPPLEMENT THE INFORMATION IN THESE REPORTS WITH INDEPENDENT RESEARCH AND OTHER PROFESSIONAL ADVICE. ALL INFORMATION ON FEATURED COMPANIES IS PROVIDED BY THE COMPANIES PROFILED, OR IS AVAILABLE FROM PUBLIC SOURCES AND DEDICATED INVESTORS LLC MAKES NO REPRESENTATIONS, WARRANTIES OR GUARANTEES AS TO THE ACCURACY OR COMPLETENESS OF THE DISCLOSURE BY THE PROFILED COMPANIES. NONE OF THE MATERIALS OR ADVERTISEMENTS HEREIN CONSTITUTE OFFERS OR SOLICITATIONS TO PURCHASE OR SELL SECURITIES OF THE COMPANIES PROFILED HEREIN AND ANY DECISION TO INVEST IN ANY SUCH COMPANY OR OTHER FINANCIAL DECISIONS SHOULD NOT BE MADE BASED UPON THE INFORMATION PROVIDED HEREIN. INSTEAD DEDICATED INVESTORS LLC STRONGLY URGES YOU CONDUCT A COMPLETE AND INDEPENDENT INVESTIGATION OF THE RESPECTIVE COMPANIES AND CONSIDERATION OF ALL PERTINENT RISKS. READERS ARE ADVISED TO REVIEW SEC PERIODIC REPORTS: FORMS 10-Q, 10K, FORM 8-K, INSIDER REPORTS, FORMS 3, 4, 5 SCHEDULE 13D.DEDICATED INVESTORS LLC IS COMPLIANT WITH THE CAN SPAM ACT OF 2003. DEDICATED INVESTORS LLC DOES NOT OFFER SUCH ADVICE OR ANALYSIS, AND DEDICATED INVESTORS LLC FURTHER URGES YOU TO CONSULT YOUR OWN INDEPENDENT TAX, BUSINESS, FINANCIAL AND INVESTMENT ADVISORS. INVESTING IN MICRO-CAP AND GROWTH SECURITIES IS HIGHLY SPECULATIVE AND CARRIES AND EXTREMELY HIGH DEGREE OF RISK. IT IS POSSIBLE THAT AN INVESTORS INVESTMENT MAY BE LOST OR IMPAIRED DUE TO THE SPECULATIVE NATURE OF THE COMPANIES PROFILED.THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 PROVIDES INVESTORS A SAFE HARBOR IN REGARD TO FORWARD-LOOKING STATEMENTS. ANY STATEMENTS THAT EXPRESS OR INVOLVE DISCUSSIONS WITH RESPECT TO PREDICTIONS, EXPECTATIONS, BELIEFS, PLANS, PROJECTIONS, OBJECTIVES, GOALS, ASSUMPTIONS OR FUTURE EVENTS OR PERFORMANCE ARE NOT STATEMENTS OF HISTORICAL FACT MAY BE FORWARD LOOKING STATEMENTS. FORWARD LOOKING STATEMENTS ARE BASED ON EXPECTATIONS, ESTIMATES, AND PROJECTIONS AT THE TIME THE STATEMENTS ARE MADE THAT INVOLVE A NUMBER OF RISKS AND UNCERTAINTIES WHICH COULD CAUSE ACTUAL RESULTS OR EVENTS TO DIFFER MATERIALLY FROM THOSE PRESENTLY ANTICIPATED. FORWARD LOOKING STATEMENTS IN THIS ACTION MAY BE IDENTIFIED THROUGH USE OF WORDS SUCH AS PROJECTS, FORESEE, EXPECTS, WILL, ANTICIPATES, ESTIMATES, BELIEVES, UNDERSTANDS, OR THAT BY STATEMENTS INDICATING CERTAIN ACTIONS & QUOTE; MAY, COULD, OR MIGHT OCCUR. UNDERSTAND THERE IS NO GUARANTEE PAST PERFORMANCE WILL BE INDICATIVE OF FUTURE RESULTS. IN PREPARING THIS PUBLICATION, DEDICATED INVESTORS LLC HAS RELIED UPON INFORMATION SUPPLIED BY ITS CUSTOMERS, PUBLICLY AVAILABLE INFORMATION AND PRESS RELEASES WHICH IT BELIEVES TO BE RELIABLE; HOWEVER, SUCH RELIABILITY CANNOT BE GUARANTEED. INVESTORS SHOULD NOT RELY ON THE INFORMATION CONTAINED IN THIS WEBSITE. RATHER, INVESTORS SHOULD USE THE INFORMATION CONTAINED IN THIS WEBSITE AS A STARTING POINT FOR DOING ADDITIONAL INDEPENDENT RESEARCH ON THE FEATURED COMPANIES. THE ADVERTISEMENTS IN THIS WEBSITE ARE BELIEVED TO BE RELIABLE, HOWEVER, DEDICATED INVESTORS LLC AND ITS OWNERS, AFFILIATES, SUBSIDIARIES, OFFICERS, DIRECTORS, REPRESENTATIVES AND AGENTS DISCLAIM ANY LIABILITY AS TO THE COMPLETENESS OR ACCURACY OF THE INFORMATION CONTAINED IN ANY ADVERTISEMENT AND FOR ANY OMISSIONS OF MATERIALS FACTS FROM SUCH ADVERTISEMENT. DEDICATED INVESTORS LLC IS NOT RESPONSIBLE FOR ANY CLAIMS MADE BY THE COMPANIES ADVERTISED HEREIN, NOR IS DEDICATED INVESTORS LLC RESPONSIBLE FOR ANY OTHER PROMOTIONAL FIRM, ITS PROGRAM OR ITS STRUCTURE. DEDICATED INVESTORS LLC IS NOT AFFILIATED WITH ANY EXCHANGE, ELECTRONIC QUOTATION SYSTEM, THE SECURITIES EXCHANGE COMMISSION OR FINRA.