***Sponsored by LFG Equities Corp & Disseminated on behalf of Nexmetals Mining Corp

NexMetals Receives US$150 Million Letter of Interest from the Export-Import Bank of the United States for Its Critical Metals Projects in Botswana

Positioned in Botswana, one of the world’s most stable mining jurisdictions

Global demand for copper is expected to double by 2035 to meet clean energy targets while major copper discoveries have plummeted by more than 80% since 2010, leaving the market struggling to fill the gap

Donald Trump announced a 50% tariff on copper imports, stunning the market and sending prices surging past $5.60 per pound

________________________

Hello Everyone,

RECAP ******

We have something that we want you to research again ahead of the open on Thursday. This one just upllsted to the Nasdaq very recently and has been holding it’s own.

This one operates in the mining sector but this isn’t just another mining company exploring in some far off lands. This one has real catalysts behind it and the whole environment surrounding copper makes this company worth researching and putting it on your radar moving forward.

Something that could be a major driver for this sector is that on July 8th, Donald Trump announced a 50% tariff on copper imports,¹stunning the market and sending prices surging past $5.60 per pound.

It’s one of the boldest trade moves of his presidency and a game-changer for the global copper supply chain.

The message is clear: the US wants to reduce reliance on foreign copper.

It’s not just a commodity anymore. It’s a strategic asset.

And that means one thing…

The market is shifting toward copper developers tied to domestic and allied supply chains.

Global demand for copper is exploding, driven by EVs, AI infrastructure, defense, and energy transition megaprojects.²

But supply is bottlenecked. Major discoveries have collapsed by over 80% since 2010.³

40% of current output comes from politically unstable jurisdictions.⁴ And it takes over 15 years, on average, to build a new mine from scratch.⁵

Source: bhp.com⁶

Now layer in tariffs and suddenly, companies with clean corporate structures, strong copper assets, and projects in stable, mining-friendly regions look like some of the most strategic opportunities in the sector.

That’s where NEXM comes in.

This newly restructured copper-nickel explorer holds two past-producing mines in Botswana—one of the most politically stable jurisdictions on the planet, often called “the Switzerland of Africa.”⁷

In June 2025, the company completed a 20-for-1 share consolidation, bringing its total share count to just ~21.45 million — a critical move to support an the recent Nasdaq uplisting, which could provide the company exposure to significantly larger pools of US capital.

NexMetals isn’t just sitting on potential, they already control a newly confirmed 24.7 Mt (Inferred) and 3 Mt (Indicated)⁸ averaging 2.92-3.40% copper equivalent of defined high-grade copper-nickel-cobalt sulphide resources at Selebi⁹ — with high-grade zones identified and aggressive expansion drilling now underway.

NexMetals Mining Corp. NEXM also holds the past-producing Selkirk Mine, where a newly published NI 43-101 resource outlines an additional 44.2 Mt (Inferred) of copper-nickel-palladium-platinum sulphide mineralization averaging 0.81% copper equivalent — providing a second major growth platform and even more exposure to critical metals.

Even better, they’ve secured a CA$67 million recapitalization¹⁰ — led by Frank Giustra’s Fiore Group, a group with deep mining sector success and EdgePoint Investment Group, one of Canada’s top institutional investors.

And with critical minerals now designated a national security priority by the US, Europe, and Canada, companies like NexMetals— potentially offering new, scalable copper-nickel supply in a stable jurisdiction — are moving to the front of the line.

The project already benefits from infrastructure, permitting, and potential expansion catalysts.

Reviving Two Past-Producing Mines At The Center Of The Critical Minerals Boom

NEXM is a revitalized copper-nickel explorer that’s about to put Botswana’s Selebi and Selkirk mines back on the global map.

Rooted in a Tier One mining jurisdiction, NexMetals controls two past-producing, permitted mines — the Selebi Complex and the Selkirk Mine — once owned and operated by BCL Limited.

Their current resource?

Over 24.7 Mt (Inferred) and 3 Mt (Indicated) of defined high-grade copper-nickel-cobalt sulphide resources — averaging 2.92-3.40% copper equivalent at Selebi¹²— and a further 44.2 million tonnes (Inferred) of copper-nickel-palladium-platinum mineralization averaging 0.81% copper equivalent at Selkirk.

But here’s what makes NEXM different…

The Selebi North underground is already re-opened, the exploration drifts are advancing, an aggressive drill program is underway and fully funded by a CA$67 million recapitalization backed by Frank Giustra’s Fiore Group and EdgePoint Investment Group.

Frank Giustra is not just a financier; he’s a serial mining entrepreneur with a track record that speaks for itself.

He is notable for helping build Goldcorp,¹³ one of Canada’s most iconic gold producers, and Wheaton Precious Metals,¹⁴ a trailblazer in the streaming model that revolutionized mining finance and has structured and financed multiple world-class mining ventures, resulting in billions in market cap growth.

He also founded Lionsgate Entertainment, a global film powerhouse — underscoring his rare ability to build billion-dollar companies across sectors.

Giustra’s network — including connections with global financiers, institutional investors, and industry insiders — opens doors to new funding, strategic partnerships, and long-term growth.

Having Giustra as a strategic advisor is a signal to the market: NEXM is on the radar of top-tier institutional investors, and this project is built to scale.

He’s not just investing in NexMetals; he’s providing the strategic guidance needed to unlock the full potential of Selebi and Selkirk, with the intention of turning both into world-class assets in one of the most stable mining jurisdictions in Africa.

And to support that vision, NexMetals has expanded its leadership bench with two key appointments.

In June 2025, NexMetals welcomed former Lundin Mining finance leader Brett MacKay as CFO to support the company’s capital strategy and markets, while Lindsey Le Ho was appointed Corporate Secretary to bolster governance as the company transitions to a more globally visible platform.

These additions reflect NexMetals’ evolution from a recapitalized junior into a fully integrated, growth-stage company — one equipped not just with projects and capital, but with the team to execute at scale.

Meanwhile, at Selkirk, surface drilling and metallurgical optimization studies are setting the stage for another leg of growth — giving NexMetals not just one, but two catalysts for value creation.

And they’re moving fast.

NexMetals is targeting near-term resource expansions, future production, and strategic optionality in a supply-constrained market desperate for new copper-nickel supply.

NEXM controls two permitted past-producing copper-nickel sulphide mines — Selebi and Selkirk — right in the heart of Botswana’s critical minerals corridor.

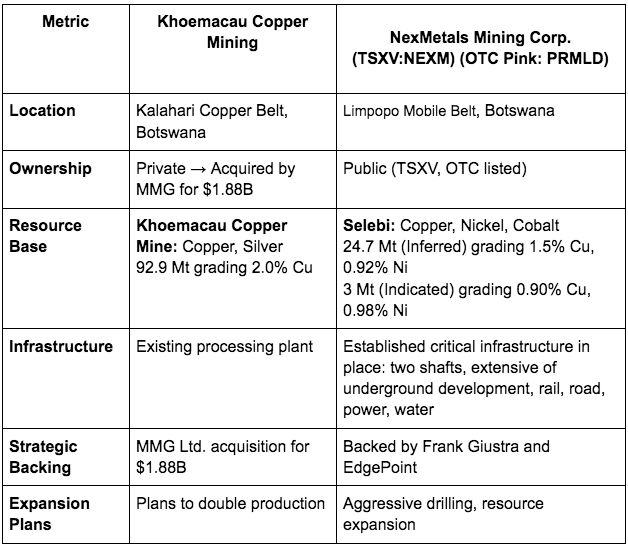

As of December 31, 2022, the Zone 5 deposit at Khoemacau Copper Mining had a total mineral resource of approximately 92.9 million tonnes grading 2.0% copper and 21.3 grams per tonne silver.¹⁷

NEXM has already outlined over 24.7 Mt (Inferred) and 3 Mt (Indicated) of high-grade resources at Selebi,¹⁸ with aggressive expansion drilling underway to uncover new conductive targets even deeper and further along strike.

The company just completed a transformative $67 million recapitalization, erasing legacy debt and funding a full pivot to resource growth.¹⁹

Like Khoemacau before its breakout, NEXM is advancing ahead of the capital stampede now targeting critical minerals supply — not trailing behind it.

The difference?

Today, the world needs copper even more urgently than when Khoemacau started.

With a high-grade copper-nickel-cobalt resource and a refreshed balance sheet, NexMetals is shaping up to be one of the most strategic redevelopment stories in southern Africa.

Botswana has already proven it can deliver billion-dollar mining success stories.

MAJOR CATALYSTS TO RESEARCH

Copper is entering a full-blown supply crisis: The world is expected to need three times more copper by 2035, but major discoveries have collapsed by over 80% since 2010.²⁰ Prices are already pushing toward all-time highs — and the squeeze is just beginning.

Two past-producing, high-grade critical minerals mines: With a combined tonnage of 68.9 Mt (Inferred) and 3Mt (Indicated) between Selebi and Selkirk — and brownfield infrastructure and key permitting in place — NexMetals has a serious head start most juniors can only dream of.

High-grade expansion drilling is already underway: NEXM is aggressively targeting new conductive plates beyond the known deposits — including the untested hinge zone potentially connecting Selebi North and Main.

Fully recapitalized with strategic backing: Frank Giustra’s Fiore Management and EdgePoint Investment Group have repositioned NexMetals with minimal debt and the capital needed to drive near-term growth.

Located in one of the safest, mining-friendly jurisdictions on Earth: Botswana’s political stability, mining laws, and critical minerals focus make it the ideal jurisdiction — especially as political risk rises in Chile, Peru, and the DRC.

Early-mover advantage before a potential Nasdaq uplisting: Management has laid out a path toward a US uplisting — a move that could unlock a much broader investor base in 2025.²¹

Multiple catalysts in motion: Drill results, potential resource updates, metallurgical optimization and underground development progress all stack up to near-term news flow.

Key players are paying attention: NEXM not only offers similar jurisdictional advantages, brownfield upside, and expansion potential — but at an early valuation stage.

NexMetals Receives US$150 Million Letter of Interest from the Export-Import Bank of the United States for Its Critical Metals Projects in Botswana

Vancouver, British Columbia–(Newsfile Corp. – July 17, 2025) – NexMetals Mining Corp. (TSXV: NEXM) (NASDAQ: NEXM) (“NEXM” or the “Company“) is pleased to announce that it has received a non-binding letter of interest (“LI“) from the Export-Import Bank of the United States (“EXIM“). The LI indicates the potential for up to US $150 million in financing, with a maximum 15-year repayment tenor, to support the re-development of NEXM’s Selebi and Selkirk nickel-copper-cobalt-platinum group metal mines in Botswana.

EXIM has also advised that procurement of U.S. goods and services for the Selebi and Selkirk mines may be eligible for special consideration under the provisions of Section 402 of EXIM’s 2019 reauthorization (P.L. 116-94), under EXIM’s China and Transformational Exports Program (“CTEP“).

Morgan Lekstrom, CEO of NEXM, commented: “This represents a willingness from the United States to fund critical metals projects in one of Africa’s safest and most stable jurisdictions. It clearly denotes the U.S. government’s specific interest in Botswana, recognizing both its rich mineral endowment and the scale of our high-grade projects. Given the quality and size of our resources and the pace of current activity, we anticipate our aggressive growth trajectory to align with our shared objective of delivering new, sustainable sources of critical metals for the U.S. and its allies contributing to the future of the global critical metals supply chain.”

The LI is non-binding and as such is not an explicit indication of the financial or commercial viability of a transaction. Upon receipt of an application for financing, further processing, including standard due diligence by U.S. EXIM, is required before issuing a final commitment for a potential transaction.

About Export-Import Bank of the United States

The Export-Import Bank of the United States (EXIM) is the official export credit agency of the United States with the mission of supporting American jobs by facilitating U.S. exports. To advance American competitiveness and assist U.S. businesses as they compete for global sales, EXIM offers financing including export credit insurance, working capital guarantees, loan guarantees, and direct loans. As an independent federal agency, EXIM contributes to U.S. economic growth by supporting tens of thousands of jobs in exporting businesses and their supply chains across the United States. Learn more at www.exim.gov.

NexMetals Drills 16.25 Metres of 3.06% CuEq Including 5.28% CuEq over 6.45 Metres Increasing the Selebi North South Limb Plunge Extent by 35%

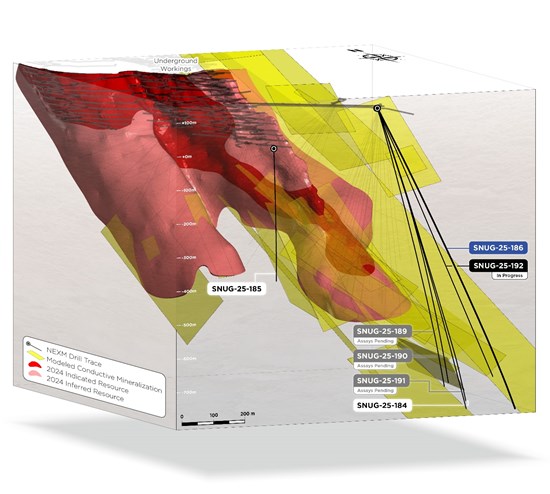

Vancouver, British Columbia–(Newsfile Corp. – August 13, 2025) – NexMetals Mining Corp. (TSXV: NEXM) (NASDAQ: NEXM) (the “Company” or “NEXM“) reports assay results from an additional drill hole successfully intersecting high-grade mineralization at the Selebi North Underground (“SNUG“) deposit. Drill hole SNUG-25-186 was designed as a follow-up to borehole electromagnetic (“BHEM“) anomalies detected in SNUG-25-184 and confirms a significant down-plunge extension of the South Limb mineralization beyond the 2024 Mineral Resource Estimate (“MRE“).

Key Highlights:

- Drill Hole SNUG-25-186: 315 metres down-plunge of South Limb

- 16.25 metres of 3.06% CuEq (1.13% Cu, 0.94% Ni)

Including: 10.45 metres of 4.16% CuEq (1.62% Cu, 1.24% Ni)

Including: 6.45 metres of 5.28% CuEq (2.30% Cu, 1.44% Ni)

- Previously announced South Limb drill hole SNUG-25-184 intercepted 13.50 metres of 3.68% CuEq (1.13% Cu, 1.24% Ni) 183 metres down plunge of 2024 MRE (see news release dated June 30, 2025).

- Down-plunge extent of South Limb expanded by 35%, with SNUG-25-184 and 186 extending mineralization 315 metres down-plunge beyond the current MRE, which has a 990 metre down-plunge extent (Figure 1).

- Additional drilling is in progress to continue the strike extent of the new mineralization.

Why This Matters:

- Confirms high-grade continuity – Demonstrates the presence of significant high-grade mineralization as drilling moves deeper.

- Supports resource expansion potential – Increases the likelihood of adding tonnage and enhancing the project’s economic profile in a future updated MRE.

- Strengthens project economics – Higher grades and resource expansion could translate into improved mine life and profitability.

Figure 1: Location of drill holes relative to the 2024 MRE and underground infrastructure.

To view an enhanced version of this graphic, please visit: https://images.newsfilecorp.com/files/7759/262293_15db49f704554a63_002full.jpg

Morgan Lekstrom, CEO of the Company, commented: “The continued extension of high-grade copper and nickel mineralization at Selebi North is a significant step in the right direction, highlighting how much potential was previously undefined. We continue to show high-grade intercepts that speak to the strength and scale of this system. The results today reinforce our growing confidence and support our strategy of driving additional value through targeted drilling, unlocking the full potential of this asset. Selebi North is only one of three large deposits we are actively drilling, each demonstrating exceptional copper, nickel, cobalt +/- PGE mineralization. We believe all of our assets have strong resource expansion potential and could be well-positioned to become a big part of the global critical metals supply chain.”

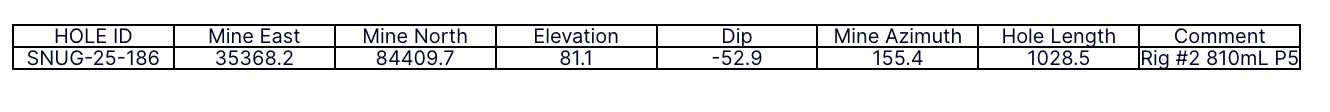

Assay results have been received and reported below in Table 1 and drill hole collar details are provided in Table 2. Assays are pending for all other drill holes described herein.

The various mineralized zones have been historically mined and subsequently named N2 Limb, N3 Limb and South Limb to demarcate their location on the folded mineralized horizon. Additional drilling is needed to properly determine true width of mineralization on each limb and define the folded mineralization.

1Length refers to drillhole length and not true width. True widths are unknown. 2Co is not included in the MRE as cobalt analyses are not consistently available throughout the deposit. 3CuEq was calculated using the formula CuEq=Cu+2.06*Ni assuming long-term prices of US$10.50/lb Ni and US$4.75/lb Cu, and nickel and copper recoveries of 72.0% and 92.4%, respectively, derived from metallurgical studies which consider a conceptual bulk concentrate scenario.

Table 2: Drill Collar Information Selebi North Deposit

Next Steps

Drilling is ongoing at SNUG to test the strike extent of this new mineralization, with assay results pending for additional holes including SNUG-25-189, which intersected mineralization in both South Limb and N2 Limb.

Qualified Person

All scientific and technical information in this news release has been reviewed and approved by Sharon Taylor, VP Exploration of the Company, MSc, P.Geo, and a “qualified person” for the purposes of National Instrument 43-101 and Subpart 1300 of Regulation S-K.

Quality Control

Drill core samples are BQTK (40.7 mm diameter). All samples are ½ core cut by a diamond saw on site. Half of the core is retained for reference purposes. Samples are generally 1.0 to 1.5 metre intervals or less at the discretion of the site geologists. Sample preparation and lab analysis was completed at ALS Chemex in Johannesburg, South Africa. Commercially prepared blank samples and certified Cu/Ni sulphide analytical control standards with a range of grades are inserted in every batch of 20 samples or a minimum of one set per sample batch. Analyses for Ni, Cu and Co are completed using a peroxide fusion preparation and ICP-AES finish (ME-ICP81).

Holes are numbered as follows: SNUG (Selebi North Underground) + year + hole number starting at 013.

Technical Report

The MRE on the Selebi Mine is supported by the technical report entitled “Technical Report, Selebi Mines, Central District, Republic of Botswana” and dated September 20, 2024 (with an effective date of June 30, 2024) (the “Selebi Technical Report“), and prepared by SLR Consulting (Canada) Ltd. for NEXM. Reference should be made to the full text of the Selebi Technical Report, which was prepared in accordance with NI 43-101 and Subpart 1300 of Regulation S-K and is available on SEDAR+ (www.sedarplus.ca) and EDGAR (www.sec.gov), in each case, under NEXM’s issuer profile.

NEWS

Aug 13, 2025

Jul 28, 2025

Jul 23, 2025

NexMetals Appoints Philipa Varris to Board of Directors

Jul 17, 2025

Jul 16, 2025

NexMetals Begins Trading on the Nasdaq Under the Symbol NEXM

Jul 9, 2025

Jun 30, 2025

Jun 24, 2025

NexMetals Accelerates Drilling at Selkirk Deposit by Adding Another Drill for Resource Expansion

Jun 18, 2025

NexMetals Hosts Investor Town Hall with Senior Leadership

Jun 18, 2025

NexMetals Announces Effective Date of Share Consolidation

Jun 16, 2025

Jun 11, 2025

NexMetals Commences Trading Under New Symbol “NEXM”

Jun 9, 2025

Premium Announces Name Change to NexMetals Mining Corp. and Changes Trading Symbol to NEXM

Jun 4, 2025

Premium Announces Results of Annual General and Special Shareholders’ Meeting

Jun 3, 2025

May 27, 2025

May 15, 2025

May 8, 2025

May 6, 2025

May 1, 2025

Premium Drills Significant Mineralized Step-Out at Selebi North

Apr 24, 2025

Premium Appoints Mining Finance Executive and Former Gatos Silver CFO Andre van Niekerk to the Board

Apr 17, 2025

Apr 10, 2025

Premium Resources High Impact Six Month Strategy Including Deep Drilling at Selebi

Mar 25, 2025

Premium Appoints Former Blackrock Senior Executive Chris Leavy to Board of Directors

Mar 18, 2025

Feb 20, 2025

Feb 18, 2025

Jan 27, 2025

Jan 10, 2025

Jan 10, 2025

Premium Resources Announces Quarterly Director DSU Grants

Management

Morgan Lekstrom

Chief Executive Officer & Director

Mr. Lekstrom has over 17 years of experience in the mining industry, with a diverse background in executive and project management, operations, and engineering. He has an established track record of delivering successes, including most recently, the successful building of NexGold Mining Corp, creating a near term development company with a clear path to building two new Canadian gold mines. This was accomplished through deleveraging and restructuring debt, setting a new strategic direction for the company through multiple back-to-back mergers / acquisitions of Blackwolf Copper and Gold Ltd. and Treasury Metals Inc., and then Signal Gold Inc. in 2024.

He has also held senior technical roles with experience at Freeport McMoran’s Grasberg site in Indonesia and Rio Tinto’s Oyu Tolgoi Project in Mongolia. He has direct African experience through his role with Golden Star Resources in supporting the redevelopment of an underground mine in Ghana, West Africa. Morgan has also served as engineering manager at Sabina Gold & Silver Corp., where he was responsible for the first phases of execution at the Back River Marine Laydown Project.

Sean Whiteford

President

Mr. Sean Whiteford is an accomplished geologist and mining executive with over 30 years of multi commodity experience within the global resource sector. He has extensive knowledge of mineral exploration, resource definition, mining, strategy, technology and project studies having held various corporate, operational and technical roles at BHP, Rio Tinto and Cliffs Natural Resource. Mr. Whiteford also has a strong business development background and has completed the Advanced Management Program from Columbia Business School. Most recently he was Vice President, Business Development at Burgundy Diamond Mines Ltd (ASX:BDM) and a Director of Premium Resources Ltd. He is a Member of the AUSIMM, PDAC, and SEG.

Brett MacKay

Senior Vice President & Chief Financial Officer

Brett MacKay is a seasoned finance executive with over 17 years of experience in the mining industry, most recently serving as the Company’s Vice President of Finance. Prior to joining the Company in October 2024, Brett held the role of Director of Financial Reporting at Lundin Mining Corporation. Throughout his 11 year tenure at Lundin, Brett led critical aspects of internal and external financial reporting, regulatory compliance, financial planning and analysis, treasury and cash management, systems strategy and implementation, and capital projects oversight, while managing global audits and supporting due diligence for international acquisitions. His leadership extended across operations in Brazil, Chile, and Argentina, where he played a pivotal role in integrating newly acquired assets into the broader corporate structure.

Brett is known for his strong technical accounting expertise and managing complex corporate structures across multiple jurisdictions. He has built and managed high-performing finance teams and worked directly with executive leadership to drive forecasting, budgeting, treasury operations, strategic financial planning, and robust project controls. His ability to translate complex financial data into meaningful insights has made him a trusted advisor in the mining sector. His proven track record in supporting growth-stage mining companies makes him a valuable addition to NexMetals as it advances toward development and long-term value creation.

Jaclyn Ruptash

Vice President Communications & Investor Relations

Jaclyn Ruptash has 20 years of domestic and international experience in the resources sector with an accomplished background in communications, corporate governance, legal and regulatory compliance, and financing. Prior to joining NexMetals Mining Corp., Jaclyn held senior positions with several mining companies including with NexMetals Mining founding shareholder, formerly North American Nickel. She has been involved in all aspects of the operations with a variety of public and privately owned companies with direct responsibility for all continuous disclosure requirements, board and committee matters, corporate transactions, shareholder communications and corporate records. She has extensive experience in public and media relations, operations, and stakeholder communications.

Sharon Taylor, P. Geo.

Vice President Exploration

Ms. Sharon Taylor holds a B. Sc. from Mount Allison University and an M. Sc. from Queen’s University. She has over 35 years of experience in mineral exploration, including thirteen years with Falconbridge, Noranda, and Xstrata. She has experience in both volcanogenic massive sulfide and nickel exploration in major mining camps including Kidd Creek, Bathurst, Raglan, Sudbury and Kabanga. Her international exploration experience includes nickel projects in Tanzania and Greenland. Ms. Taylor’s area of expertise is the application and interpretation of EM data and integrating results from airborne, ground and downhole EM methods.

Gerry Katchen, P. Geo

Exploration Manager

Mr. Katchen has over 23 years of experience in mineral exploration and mining in North America Greenland, Finland, Tanzania and Botswana. Gerry obtained his B.Sc from Brandon University in 1998, and has since specialized in the global exploration for Nickel, Copper and Platinum Group Metals hosted within intrusive Mafic/Ultramafic sulphide systems.

Gerry’s former experience with North American Palladium, Placer Dome, Continental Nickel and as Exploration Manager for NEXM has provided a solid foundation in the systematic approach and application of shallow and deep exploration technologies and methods. His career highlights include the discovery of the Ntaka Hill Nickel-Copper Deposit in Tanzania for Continental Nickel and the PQ_Deeps discovery in Ontario, Canada for Placer Dome.

SINCERELY,

DISCLAIMER

THIS WEBSITE/NEWSLETTER IS OWNED SUBSIDIARY BY DEDICATED INVESTORS, LLC.DISCLAIMER

[1] https://ici.radio-canada.ca/rci/en/news/2178155/trump-says-he-will-impose-50-tariff-on-copper [2] https://cdn.ihsmarkit.com/www/pdf/0722/The-Future-of-Copper_Full-Report_14July2022.pdf [3] https://aheadoftheherd.com/exposing-the-copper-surplus-myth-richard-mills/ [4] https://discoveryalert.com.au/news/copper-geopolitical-significance-2025/ [5] https://www.spglobal.com/market-intelligence/en/news-insights/research/from-6years-to-18years-the-increasing-trend-of-mine-lead-times [6] https://www.bhp.com/news/bhp-insights/2024/12/visualised-major-copper-discoveries-since-1900 [7] https://activeafrica.travel/destination/botswana/ [8] https://premiumresources.com/investors/news-releases/premium-nickel-files-ni-43-101-technical-report-i-9517/ [9] https://premiumresources.com/projects/botswana/selebi-mine/overview/ [10] https://premiumresources.com/investors/news-releases/premium-resources-announces-new-strategic-investor-9944/ [11] https://simplywall.st/stocks/us/materials/otc-prml.f/premium-resources/ownership [12] https://www.newsfilecorp.com/release/250953/Premium-Announces-Intention-to-List-on-the-NASDAQ-and-Provides-Details-for-Upcoming-Annual-General-Special-Meeting [13] https://premiumresources.com/projects/botswana/selebi-mine/overview/ [14] https://mininghalloffame.ca/frank-giustra-b-1957/ [15] https://mininghalloffame.ca/frank-giustra-b-1957/ [16] https://www.mining.com/web/mmg-to-invest-700-million-to-double-copper-output-at-botswana-mine [17] https://www.mccarthy.ca/en/work/cases/mmg-limited-completes-share-purchase-agreement-acquire-cuprous-capital-us188b [18] https://www.costmine.com/wp-content/uploads/2023/11/Khoemacau-2021-Maiden-Copper-Resource-Report-07-27-A.pdf [19] https://premiumresources.com/projects/botswana/selebi-mine/overview/ [20] https://www.tradingview.com/news/reuters.com,2025-04-22:newsml_TnwzR5XX:0-premium-resources-confirms-high-grade-copper-nickel-zone-in-botswana-begins-resource-expansion/ [21] https://aheadoftheherd.com/exposing-the-copper-surplus-myth-richard-mills/ [22] https://www.newsfilecorp.com/release/250953/Premium-Announces-Intention-to-List-on-the-NASDAQ-and-Provides-Details-for-Upcoming-Annual-General-Special-Meeting [23] https://premiumresources.com/investors/news-releases/premium-nickel-files-ni-43-101-technical-report-i-9517/ The MRE described in this news release has been reviewed and approved by Valerie Wilson, M.Sc., P.Geo. (Ontario) and a Principal Resource Geologist at SLR Consulting Ltd., who is independent of PNRL and a “qualified person” for purposes of NI 43-101. [24] https://www.costmine.com/wp-content/uploads/2023/11/Technical-Report-for-Selebi-Mines.pdf [25] https://paradigmcap.documents.streetcontxt.com/attachment/attachment%2FMTIwODY2ZTIxMmMyYmYwY2E1OWU3YzJjOTliN2NhOTg%3D.pdf?filename=UE5STCAtIFByZW1pdW0gTmlja2VsIC0gQm90c3dhbmEgLSBSZWp1dmVuYXRpbmcgSXRzIE5pY2tlbCBJbmR1c3RyeS5wZGY%3D [26] https://premiumresources.com/investors/news-releases/premium-nickel-files-ni-43-101-technical-report-i-9517/ [27] https://www.gurufocus.com/news/2786346/premium-resources-infill-drilling-at-selebi-delivers-grades-significantly-higher-than-mineral-resource-estimate-2755-metres-of-497-cueq-prmlf-stock-news [28] https://premiumresources.com/investors/news-releases/premium-resources-infill-drilling-at-selebi-delive-10052/ [29] https://www.juniorminingnetwork.com/junior-miner-news/press-releases/886-tsx-venture/prem/179314-premium-drills-significant-mineralized-step-out-at-selebi-north.html [30] https://nexmetalsmining.com/investors/news-releases/nexmetals-drills-13-50-metres-of-3-68-cueq-expand-10212/ [31] https://premiumresources.com/investors/news-releases/premium-nickel-files-ni-43-101-technical-report-i-9517/ The MRE described in this news release has been reviewed and approved by Valerie Wilson, M.Sc., P.Geo. (Ontario) and a Principal Resource Geologist at SLR Consulting Ltd., who is independent of PNRL and a “qualified person” for purposes of NI 43-101. [32] https://web.archive.org/web/20130705235906/http://www.nornik.ru/en/our_products/MineralReservesResourcesStatement/ [33] https://web.archive.org/web/20130705235906/http://www.nornik.ru/en/our_products/MineralReservesResourcesStatement/ NOTE: a qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves, and the Company is not treating the historical estimate as current mineral resources or mineral reserves. [34] https://premiumresources.com/site/assets/files/5686/selkirk_ni_43-101_mre_technical_report_nov_1_2024.pdf [35] https://premiumresources.com/site/assets/files/1/selkirk_ni_43-101_mre_technical_report_nov_1_2024.pdf [36] https://www.at-minerals.com/en/artikel/optimised-xrt-ore-sorting-solution-for-fine-particles-3951969.html [37] https://www.min-eng.com/physicalseparation24/drafts/session3/andrade.pdf [38] https://www.newsfilecorp.com/release/250953/Premium-Announces-Intention-to-List-on-the-NASDAQ-and-Provides-Details-for-Upcoming-Annual-General-Special-Meeting

OUR REPORTS/RELEASES ARE A COMMERCIAL ADVERTISEMENT AND ARE FOR GENERAL INFORMATION PURPOSES ONLY. WE ARE ENGAGED IN THE BUSINESS OF MARKETING AND ADVERTISING COMPANIES FOR MONETARY COMPENSATION. WE HAVE BEEN COMPENSATED A FEE OF FIVE THOUSAND USD BY LFG EQUITIES CORP FOR A ONE DAY NEXM AWARENESS CAMPAIGN. NEVER INVEST IN ANY STOCK FEATURED ON OUR SITE OR EMAILS UNLESS YOU CAN AFFORD TO LOSE YOUR ENTIRE INVESTMENT. THE DISCLAIMER IS TO BE READ AND FULLY UNDERSTOOD BEFORE USING OUR SERVICES, JOINING OUR SITE OR OUR EMAIL/BLOG LIST AS WELL AS ANY SOCIAL NETWORKING PLATFORMS WE MAY USE.PLEASE NOTE WELL: DEDICATED INVESTORS LLC AND ITS EMPLOYEES ARE NOT A REGISTERED INVESTMENT ADVISOR, BROKER DEALER OR A MEMBER OF ANY ASSOCIATION FOR OTHER RESEARCH PROVIDERS IN ANY JURISDICTION WHATSOEVER.RELEASE OF LIABILITY: THROUGH USE OF THIS WEBSITE VIEWING OR USING YOU AGREE TO HOLD DEDICATED INVESTORS LLC, ITS OPERATORS OWNERS AND EMPLOYEES HARMLESS AND TO COMPLETELY RELEASE THEM FROM ANY AND ALL LIABILITY DUE TO ANY AND ALL LOSS (MONETARY OR OTHERWISE), DAMAGE (MONETARY OR OTHERWISE), OR INJURY (MONETARY OR OTHERWISE) THAT YOU MAY INCUR. THE INFORMATION CONTAINED HEREIN IS BASED ON SOURCES WHICH WE BELIEVE TO BE RELIABLE BUT IS NOT GUARANTEED BY US AS BEING ACCURATE AND DOES NOT PURPORT TO BE A COMPLETE STATEMENT OR SUMMARY OF THE AVAILABLE DATA. DEDICATED INVESTORS LLC ENCOURAGES READERS AND INVESTORS TO SUPPLEMENT THE INFORMATION IN THESE REPORTS WITH INDEPENDENT RESEARCH AND OTHER PROFESSIONAL ADVICE. ALL INFORMATION ON FEATURED COMPANIES IS PROVIDED BY THE COMPANIES PROFILED, OR IS AVAILABLE FROM PUBLIC SOURCES AND DEDICATED INVESTORS LLC MAKES NO REPRESENTATIONS, WARRANTIES OR GUARANTEES AS TO THE ACCURACY OR COMPLETENESS OF THE DISCLOSURE BY THE PROFILED COMPANIES. NONE OF THE MATERIALS OR ADVERTISEMENTS HEREIN CONSTITUTE OFFERS OR SOLICITATIONS TO PURCHASE OR SELL SECURITIES OF THE COMPANIES PROFILED HEREIN AND ANY DECISION TO INVEST IN ANY SUCH COMPANY OR OTHER FINANCIAL DECISIONS SHOULD NOT BE MADE BASED UPON THE INFORMATION PROVIDED HEREIN. INSTEAD DEDICATED INVESTORS LLC STRONGLY URGES YOU CONDUCT A COMPLETE AND INDEPENDENT INVESTIGATION OF THE RESPECTIVE COMPANIES AND CONSIDERATION OF ALL PERTINENT RISKS. READERS ARE ADVISED TO REVIEW SEC PERIODIC REPORTS: FORMS 10-Q, 10K, FORM 8-K, INSIDER REPORTS, FORMS 3, 4, 5 SCHEDULE 13D.DEDICATED INVESTORS LLC IS COMPLIANT WITH THE CAN SPAM ACT OF 2003. DEDICATED INVESTORS LLC DOES NOT OFFER SUCH ADVICE OR ANALYSIS, AND DEDICATED INVESTORS LLC FURTHER URGES YOU TO CONSULT YOUR OWN INDEPENDENT TAX, BUSINESS, FINANCIAL AND INVESTMENT ADVISORS. INVESTING IN MICRO-CAP AND GROWTH SECURITIES IS HIGHLY SPECULATIVE AND CARRIES AND EXTREMELY HIGH DEGREE OF RISK. IT IS POSSIBLE THAT AN INVESTORS INVESTMENT MAY BE LOST OR IMPAIRED DUE TO THE SPECULATIVE NATURE OF THE COMPANIES PROFILED.THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 PROVIDES INVESTORS A SAFE HARBOR IN REGARD TO FORWARD-LOOKING STATEMENTS. ANY STATEMENTS THAT EXPRESS OR INVOLVE DISCUSSIONS WITH RESPECT TO PREDICTIONS, EXPECTATIONS, BELIEFS, PLANS, PROJECTIONS, OBJECTIVES, GOALS, ASSUMPTIONS OR FUTURE EVENTS OR PERFORMANCE ARE NOT STATEMENTS OF HISTORICAL FACT MAY BE FORWARD LOOKING STATEMENTS. FORWARD LOOKING STATEMENTS ARE BASED ON EXPECTATIONS, ESTIMATES, AND PROJECTIONS AT THE TIME THE STATEMENTS ARE MADE THAT INVOLVE A NUMBER OF RISKS AND UNCERTAINTIES WHICH COULD CAUSE ACTUAL RESULTS OR EVENTS TO DIFFER MATERIALLY FROM THOSE PRESENTLY ANTICIPATED. FORWARD LOOKING STATEMENTS IN THIS ACTION MAY BE IDENTIFIED THROUGH USE OF WORDS SUCH AS PROJECTS, FORESEE, EXPECTS, WILL, ANTICIPATES, ESTIMATES, BELIEVES, UNDERSTANDS, OR THAT BY STATEMENTS INDICATING CERTAIN ACTIONS & QUOTE; MAY, COULD, OR MIGHT OCCUR. UNDERSTAND THERE IS NO GUARANTEE PAST PERFORMANCE WILL BE INDICATIVE OF FUTURE RESULTS. IN PREPARING THIS PUBLICATION, DEDICATED INVESTORS LLC HAS RELIED UPON INFORMATION SUPPLIED BY ITS CUSTOMERS, PUBLICLY AVAILABLE INFORMATION AND PRESS RELEASES WHICH IT BELIEVES TO BE RELIABLE; HOWEVER, SUCH RELIABILITY CANNOT BE GUARANTEED. INVESTORS SHOULD NOT RELY ON THE INFORMATION CONTAINED IN THIS WEBSITE. RATHER, INVESTORS SHOULD USE THE INFORMATION CONTAINED IN THIS WEBSITE AS A STARTING POINT FOR DOING ADDITIONAL INDEPENDENT RESEARCH ON THE FEATURED COMPANIES. THE ADVERTISEMENTS IN THIS WEBSITE ARE BELIEVED TO BE RELIABLE, HOWEVER, DEDICATED INVESTORS LLC AND ITS OWNERS, AFFILIATES, SUBSIDIARIES, OFFICERS, DIRECTORS, REPRESENTATIVES AND AGENTS DISCLAIM ANY LIABILITY AS TO THE COMPLETENESS OR ACCURACY OF THE INFORMATION CONTAINED IN ANY ADVERTISEMENT AND FOR ANY OMISSIONS OF MATERIALS FACTS FROM SUCH ADVERTISEMENT. DEDICATED INVESTORS LLC IS NOT RESPONSIBLE FOR ANY CLAIMS MADE BY THE COMPANIES ADVERTISED HEREIN, NOR IS DEDICATED INVESTORS LLC RESPONSIBLE FOR ANY OTHER PROMOTIONAL FIRM, ITS PROGRAM OR ITS STRUCTURE. DEDICATED INVESTORS LLC IS NOT AFFILIATED WITH ANY EXCHANGE, ELECTRONIC QUOTATION SYSTEM, THE SECURITIES EXCHANGE COMMISSION OR FINRA.